FURNITURE INDUSTRY

Our company will provide you with:

- defining a group of producers that meet your requirements,,

- selection of the best producers,

- organization of meetings with potential suppliers,

- translator and guide service,

- reservation of air and rail tickets,

- accommodate you in hotels,

- car rental.

Below we present our sample analyzes related to the furniture industry. They concern the market situation in the world and in Poland. We also encourage you to familiarize yourself with the offer tailored specifically to customers from the furniture industry.

World furniture industry

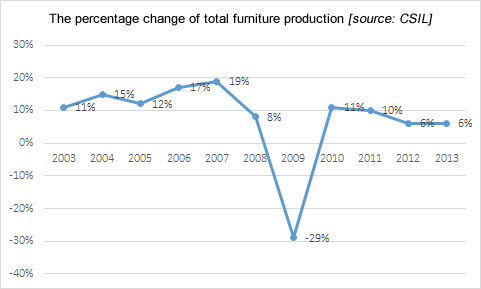

In 2012 furniture market value was estimated by the value of furniture produced at 52 billion USD. World furniture exports in 2012 were worth $ 9 billion. Trade in furniture products (average values of imports and exports) grew continuously in the years 2002-2007, and in 2009 saw a significant decline due to the financial crisis in 2008. Currently, there is a slightly positive stagnation in trade in the analyzed sector.

According to EFIC (European Furniture Industries Confederation) estimations, stagnation or a slight slow growth is expected in the furniture industry; another significant financial and economic crisis is not expected.

The largest manufacturers in the furniture industry have been China and the USA for many years. The next places are taken by Italy, Germany, India and Japan.

China has been the main exporter of furniture for years. The main target of their products are European countries (23%), the Far East (8%), Japan (6%), Australia, India, Malaysia, Indonesia and Singapore, which are among the fastest growing markets for Chinese furniture. The remaining places among the largest furniture exporters are occupied by Italy, Germany and Poland.

When it comes to furniture imports, the main driver of trade until 2006 was US furniture imports ($ 27 billion). After the crisis in the following year, the values of recent years return to the past trends.

This recession caused US furniture imports to fall from $ 26 billion in 2007 to $ 19 billion in 2009. Imports surged again in 2010, reaching $ 23 billion. All major furniture importers were hit hard by the 2008 financial crisis. By 2010, none of the major importers had returned to their pre-crisis record levels – Canada and Japan are close to it, while the UK has the slowest return to past values.

The European furniture market is responsible for 27% of world production, 28% of consumption, 46% of imports and 45% of exports. Western Europe is the third Western market in terms of furniture production and accounts for half of the world’s imports. The main benefits of the European furniture market include: flexible, innovation-oriented production, advanced production technology, reliance on sales incentives other than just price (loyalty, positioning), developed pre- and after-sales services, developed distribution channel and advanced JIT production.

The challenges of the European market are: import pressure from middle-income countries, imperfect competition in terms of labor costs, environmental and safety requirements, protectionist tendencies, increasing environmental requirements for running a business, aging workforce.

Furniture industry in Poland

The furniture industry is one of the best developed sectors of Polish economy. Currently, Poland ranks among the top ten largest furniture manufacturers in the world. In 2012, there were approximateley 100 large enterprises, 400 medium-sized enterprises, and 1.7 thousand small-sized enterprises employing up to 49 people. The number of micro-enterprises is estimated at approx. 5 thousand. In addition, there were over 20,000. enterprises from various industries related to the production of furniture (e.g. steel or glass elements). In total, 126.7 thousand people find employment in the production of furniture (data for Q2 2012). The contribution of the furniture industry to Polish GDP is estimated at 2%.

The effects of the economic crisis lasting since 2008, which to a large extent also affected Poland’s important trading partners from the euro area, is still felt in the Polish furniture industry. According to the B + R Studio company, which monitors the furniture market in Poland, in 2012 the value of sold production of companies operating in the furniture industry amounted to PLN 29.4 billion, which was a decrease by 7.3% compared to the previous year. In total, in 2012, 90 million pieces of various types of furniture were produced in Poland (including 7 million pieces of office furniture, including armchairs and swivel chairs, i.e. 1.3 million pieces more than the year before) and over 67 thousand. tonnes of metal furniture (increase by 15 thousand tonnes y / y /).

According to the Polish Ministry of Economy, the most valuable group of products supplied by Polish enterprises is upholstered furniture, including armchairs and chairs (approx. 29% share in sold production), dining room furniture (23%) and living room furniture (16%). The production of furniture elements has a 12% share, and other groups of furniture (including bedroom furniture, mattresses, as well as kitchen and office furniture) are from 1 to 7%.

According to the Polish Chamber of Commerce of Furniture Manufacturers (OIGPM), the reduction of sales revenues with a simultaneous increase in the production volume may be the result of several factors, including cheaper production, lack of revenues of companies from additional services related to finishing works at the facilities prepared a year earlier for Euro 2012, as well as consolidation of companies and reduction of subcontracting. According to OIGPM experts, the deteriorating situation on the domestic market is to a greater extent related to the reduction of investments after the Euro 2012 tournament, and to a lesser extent to the decline in interest from individual clients.

It is also worth pointing to the fact that in 2012, the production volume in three of the four main groups of furniture analyzed by the Central Statistical Office (GUS) increased in 2012 compared to the previous year (the exceptions were products from the group “furniture for seating transformable into a place to sleep”) . The largest, as much as 15%, increase in production volume was recorded in the kitchen furniture category. However, at the beginning of 2013, there were significant drops in 3 out of 4 product categories. In January and February, higher production, although by only 0.5%, was recorded in the category of wooden bedroom furniture.

At the beginning of 2013, furniture manufacturers assessed the economic climate in the industry worse than at the beginning of 2012. Equally pessimistic moods refer to the order portfolio index and declarations related to the increase in current production. The year 2012 was negatively assessed by OIGPM in terms of the companies’ ability to settle their liabilities on a current basis. Negative trends in this matter also continued at the beginning of 2013 (compared to the beginning of 2012, 11% more enterprises declared problems with settling their financial liabilities). However, it is worth paying attention to the relatively better expectations for the future regarding production in Q1 2013 compared to the last quarter of 2012.

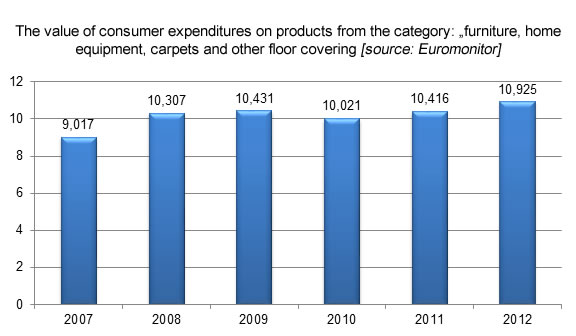

Consumers’ moods are also not optimistic. The business climate in trade in January and February 2013 in terms of products from the “Household goods” category (including electronics, household appliances and furniture) was assessed much worse than in the corresponding period in 2012. This state of affairs may be influenced by the deteriorating situation on the Polish labor market and a relatively small increase in wages, which leads to postponing the purchase of durable goods. This means that the dynamics of purchases of home furnishings by Polish consumers may decline in the short or even medium term. Euromonitor data shows that in the years 2007-2012 the value of Poles’ spending on products from the group of “furniture, home furnishings, carpets and other floor coverings” increased by over 21%, reaching the level of PLN 10.925 billion at the end of this period (in prices current). As estimated by the Polish Ministry of Economy, the value of furniture sales alone in Poland ranges from PLN 7-8 billion. Apart from the relatively high demand, an almost 25% increase in the prices of products from the indicated category could have contributed to the increase in the value of sales. Domestic furniture is responsible for approx. 50% of products sold in Poland, while the rest are imported.

Despite the worsening moods on the domestic market, the export of furniture products continues to grow. About 95% of furniture production goes to foreign recipients. Furniture export also accounts for approx. 5% of all Polish foreign sales. On a global scale, Poland is the 4th largest furniture exporter. According to B + R Studio, while goods worth PLN 22.5 billion were exported from Poland in 2010, and valued at PLN 26.6 billion in 2011 (a trade surplus of PLN 22 billion was achieved), In 2012, exports reached the level of PLN 27.9 billion.

During the economic crisis and the reduction of expenses, Polish furniture is gaining popularity among foreign customers mainly due to the lower price and comparable quality in relation to manufacturers from other European countries, as well as modern, attractive design. The furniture industry, as one of the leading Polish industries, is supported in expansion into foreign markets by government institutions, including Ministry of Economy. Furniture imports to Poland are relatively small and account for only approx. 15% the value of Polish exports of this type of product. Most furniture products are imported from Germany, China, Italy and France.