CHEMICAL INDUSTRY

Our company will provide you with:

- defining a group of producers that meet your requirements,,

- selection of the best producers,

- organization of meetings with potential suppliers,

- translator and guide service,

- reservation of air and rail tickets,

- accommodate you in hotels,

- car rental.

Below we present our sample analyzes related to the chemical industry. They concern the market situation in the world and in Poland. We also encourage you to familiarize yourself with the offer tailored specifically to customers from the chemical industry.

World chemical industry

The global value of the chemical market in 2012 was EUR 3.127 trillion. The chemical market is a very broad concept, therefore its segments are usually distinguished: processing of chemical raw materials (e.g. petrochemical products and derivatives), specialized chemistry products (e.g. paints, inks, pigments) and consumer chemicals (e.g. soap, detergents, perfumes, cosmetics).

The global financial crisis of 2007 had a significant impact on the chemical industry. The gradual improvement in the economic situation on global markets has a positive effect on the development of this sector. The value of turnover in 2012 amounted to EUR 3.127 trillion, which means that sales improved by 12.8% compared to the previous year (i.e. by EUR 356 billion). Particularly strong growth was observed in the Chinese market (by 27.1%). In Europe, the market is relatively stable, i.e. total sales in EU and non-EU countries amounted to EUR 673 billion and has been growing steadily since at least 1992. However, it is worth noting that the European Union is losing its competitive position to the United States. It is estimated that in 2014, the global market value will increase by 3.8%, and the European and American markets will gradually recover from stagnation.

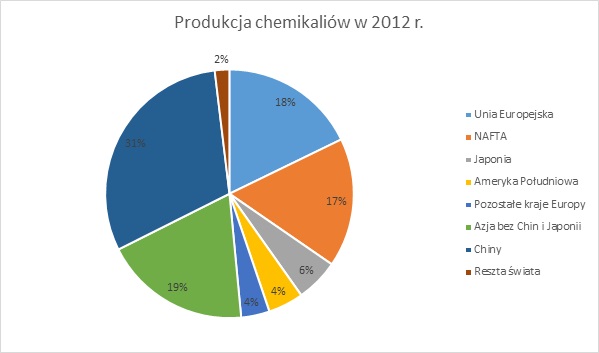

The pie chart below provides a geographic breakdown of the chemicals production in 2012 prepared by CEFIC. It can be seen that Asian countries (primarily China) are the absolute leader in production. The whole of Asia accounts for 55.2%. of global production, for Europe 21.5%, for North America – 21.4% total production of chemicals.

Source: CEFIC

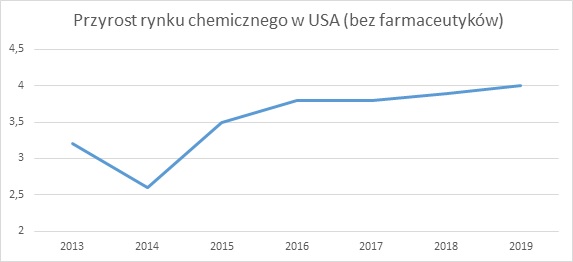

The chemical industry in the United States will develop particularly dynamically as a result of the extraction of shale gas, thanks to which it is possible to reduce the cost of gas production. An indirect effect is the expansion of new production plants. The American Industry Council predicts a 2.5% increase in production in the chemical sector. in 2014, and in the following year up to 3.5%. In the years 2015 – 2020, production on the US chemical market is expected to grow up to 4%. annually. This is a very good result, considering that the chemical industry in the United States has recorded an average growth of around 1% in the last 20 years. It is indicated, inter alia, that the demand for petrochemical products will be driven by the increase in energy consumption. It is expected that in 2014 the market segments that will lower the value of sales in the chemical segment are specialist chemicals and chemicals for agricultural applications.

Source: IHS

In Asian markets, no decline in production is expected, on the contrary – profit margins will increase due to growing demand and reduction of production surpluses. Numerous construction projects, especially in China, will increase the demand for paints and polymers. Particularly strong growth in China was observed in the years 2000-2010, when the value of production increased threefold (to the level of EUR 595 billion). According to CEFIC data, China’s share in the production of chemicals increased from 6.4 to 24.4.

There is moderate optimism in the European Union, the value of the chemical industry was expected to increase by 1.5%. in 2013. For more than 10 years, sales figures in Europe have been increasing in value, but other destinations have recorded higher values, which has resulted in a decline in Europe’s share of global sales in the chemicals sector. In 1992, with sales of EUR 290 billion, the share of the global market reached 35.2%. However, in 2012, with a sales value of EUR 558 billion, the share in the global market decreased to 11.2 %. The largest chemical markets in terms of value in the European Union are Germany, France, the Netherlands and Italy. These countries produce over 62.6%. sales of chemicals in Europe (EUR 349 billion). However, the European market is struggling with pressure from both dynamically developing Asian companies as well as low production costs from the United States. In 2012, the EU chemical sector provided jobs to 3.1 million people employed in 83,000 enterprises.

The chart below shows the countries where the chemical market will develop the most dynamically. The advantage of China and India is clearly visible, in those countries, the chemical sector will develop in 2012-2020 at the rate of 66 and 59%, respectively. Brazil, Korea and Singapore also seem to be prospective markets (growth of 35%).

Source: UNEP