FENESTRATION INDUSTRY

Our company will provide you with:

- defining a group of producers that meet your requirements,,

- selection of the best producers,

- organization of meetings with potential suppliers,

- translator and guide service,

- reservation of air and rail tickets,

- accommodate you in hotels,

- car rental.

Below we present our sample analyzes related to the fenestration industry. They concern the market situation in the world and in Poland. We also encourage you to familiarize yourself with the offer tailored specifically to customers from the fenestration industry.

World fenestration industry

The condition of the joinery industry is closely related to the construction industry. 2011 was once again a difficult year for the construction industry. There are no declines compared to previous years, but the stagnation in this industry is becoming more and more visible. Overall, spending in this industry grew by 0.5% to USD 4.6 trillion, which is still lower than in the pre-crisis 2007. Even modest growth is driven by developing countries, which, however, are projected to stagnate. which may result in somewhat pessimistic visions for the future.

All regions in the world, except Western Europe and North America, saw a percentage increase in construction spending in 2011. The regions of Asia and Latin America achieved the highest values. On the other hand, China was the largest construction market both in 2011 and 2012 in terms of expenditure. The next places were taken by the USA, Japan and Germany.

Among the largest construction markets, only China shows a development trend – furthermore, it is developing at the fastest pace in the world. It is also worth mentioning India and Brazil, which increased their construction spending by 8% and 6% respectively. As already mentioned, the construction industry is stagnating in Western Europe and North America, with increasingly visible negative increases in construction spending.

Fenestration industry in Poland

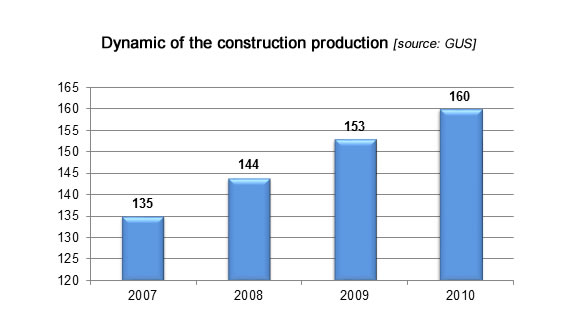

The condition of the joinery industry is closely related to the situation on the construction market. In Poland, in the last few years, despite the economic slowdown recorded in almost all of Europe, the dynamics of construction production has been steadily increasing.

The sale of construction joinery depends on individual demand, on development investments as well as state orders and export of construction and renovation services. For several years, individual demand has remained at the level of 70-80 thousand apartments sold annually. The number of developer apartments completed in 2012 amounted to over 63 thousand (an increase of 29.4% in the period 2012/2011). On the other hand, the number of building permits increased, which indicated good prospects for housing construction.

The new housing stock is mainly financed by the funds of individual investors. Their share in housing investments is at the level of 70.1%. In 2010, individual investors built by 10.5% more apartments, and in 2011 – 7.4% more new buildings. On the other hand, the low level of consumer confidence in the development sector, the financial difficulties of these companies and the high risk of such investments discourage the purchase of apartments from developers. Obtaining a mortgage for people with lower income can also be a problem.

The housing situation is strongly influenced by the prices of products for the construction industry and the product range for apartments. In 2009-2010, prices increased by 5.1%, and by mid-2011 by a further 0.2%. Due to the increase in prices, housing expenses increase significantly, and the level of inflation reduces the purchasing power of buyers, also causes an increase in the operating costs of enterprises and an increase in investment costs.

The joinery market itself is one of the most dynamically developing sectors of the Polish economy in recent years. This process has been particularly accelerated since Poland’s accession to the EU and the lifting of customs barriers to the access of Polish windows to the rich and absorbent markets of Western Europe. Currently, export is one of the pillars of the development of the entire industry.

The Polish window market is extremely fragmented. There are over 2 thousand producers, none of which have a market share of more than a few percent. In 2010, the following companies had the largest market shares: Fakro, NB Polska (producers of roof windows), Drutex and Dobroplast (producers of PVC windows). According to experts from Centrum Analiz Branżowych (Industry Analysis Center), market consolidation should be expected in the near future due to the declining income of many smaller entities.

According to the information provided by “Puls Biznesu”, in 2010, 20 million windows and doors were produced on the Vistula River, with a total value of PLN 9.2 billion. Due to the anemic growth in recent years and the significant market saturation, companies are increasingly looking for opportunities to earn from selling abroad.

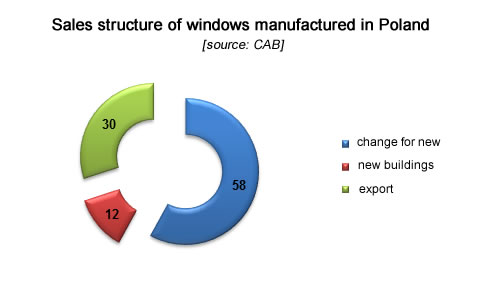

According to the Center for Industry Analysis (CAB), 58% of windows produced in 2010 in Poland were used as part of the replacement of old models (including over 51% in housing construction), 12% used in new construction (including over 9.5%), and as much as 30% of production was exported.

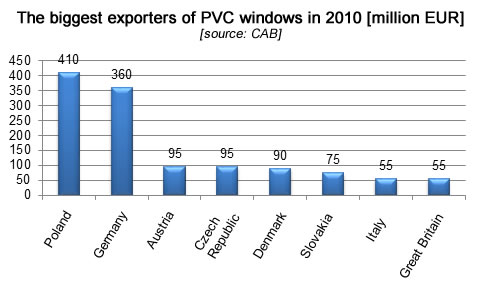

In terms of the number of windows produced, Polish enterprises are second only to companies from Germany, Great Britain and France, and including doors, Italians and Spaniards are also ahead of Poles. Currently, however, Poland is the largest European exporter of PVC and wooden windows, as well as a producer and seller of roof windows. The advantage of Polish companies is primarily modern production technology and still relatively low labor costs. There is also a government program to support the export of Polish windows – tens of millions of zlotys are to be allocated for this purpose in the coming years.

The CAB information, based on data from Eurostat, CAAC and the Central Statistical Office, shows that in the years 2004-2011 the value of Polish exports of construction joinery increased almost threefold – from EUR 315 to 890 million, while the PVC windows themselves – as much as 6.5 times (from EUR 65 to 425 million).

The chart below shows the value of Polish exports of construction joinery in 2004-2010.

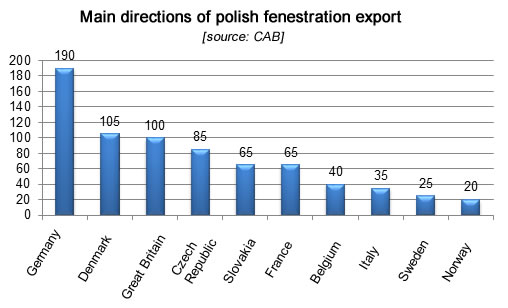

The main export directions of Polish construction joinery are the countries of Western Europe, mainly Germany, Denmark and the United Kingdom.

According to the data of the German Union of the Window Industry (VFF), the European window market, after a drop of 22.4% in 2009, it stabilized in 2010, but only increased by 0.4% – up to 125.8 million units sold, which meant an increase by 1.69 million units y / y. Among European countries, only Germany and Poland recorded an increase in the value of the window market, while Poland remains the only market that has recorded uninterrupted growth since 2008. In the short term, also in Poland, one of the factors driving the increase in the value of the window market will be the process of thermo-modernization of residential and public buildings ( this has already worked for the demand on the German market). For this purpose, government programs to support energy saving are introduced in many European countries, including Germany and France.

In Poland, like Russia or Turkey, over 70% of sold windows are made of polychloride. In Europe, the trend was somewhat halted – in 2009, their share in total sales was still high and amounted to 56%, but it meant a decrease by 2 percentage points y / y. Due to the popularization of passive (energy-saving) windows, a significant share of which is the tendency to save on bills due to the economic slowdown and deterioration of the labor market situation, their share in European sales should increase in the medium term. Products made of alternative materials, including wooden and metal profiles, are becoming more and more serious competition for PVC products. While plastic window frames maintain their dominance in Western, Central and Eastern Europe, the Scandinavians prefer wooden products.