APPAREL INDUSTRY

Our company will provide you with:

- defining a group of producers that meet your requirements,,

- selection of the best producers,

- organization of meetings with potential suppliers,

- translator and guide service,

- reservation of air and rail tickets,

- accommodate you in hotels,

- car rental.

Below we present our sample analyzes related to the apparel industry. They concern the market situation in the world and in Poland. We also encourage you to familiarize yourself with the offer tailored specifically to customers from the apparel industry.

World apparel industry

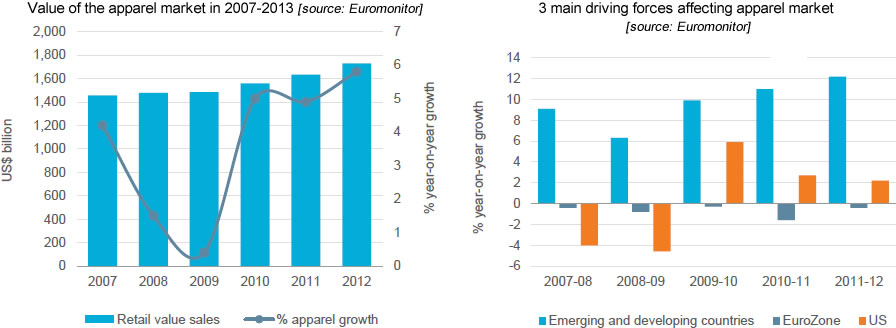

The global apparel market was valued at $ 1.7 billion in 2012. Despite the ensuing uncertainty in the industry, there was a 6% increase in market size compared to the previous year. Clothing purchases are discretionary compared to other everyday goods, which is why the industry is very susceptible to shocks. The market showed a significant recovery from the 2008/2009 crisis, mainly thanks to the participation of emerging and developing markets – which also showed a stagnation in the leading players in the garment market. Overall, there are three main drivers of the apparel market in 2012: significant growth in developing countries, visible improvement in the United States after the 2008 crisis, and a significant slowdown in Western Europe.

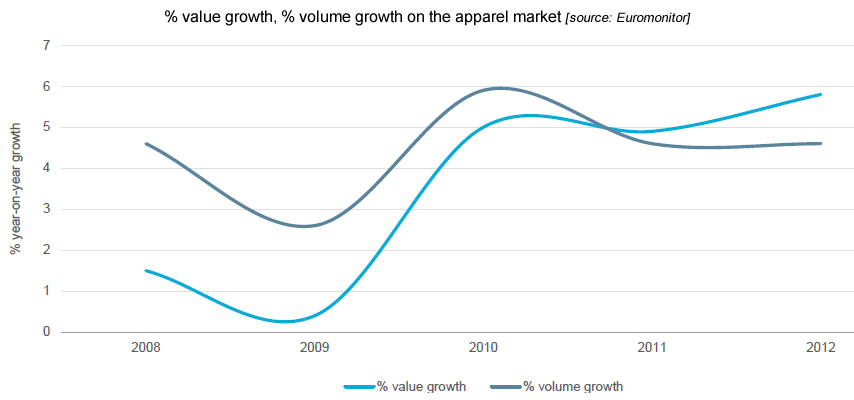

The value of sales on the clothing market is clearly increasing after the financial crisis. This is mainly due to emerging markets, where well-known brands are becoming more and more popular, slowly replacing mass unbranded products. When it comes to the quantitative sale of products in the clothing industry, it has been stagnating since 2011. It is explained by the interest in branded products in Western Europe and North America, which results in fewer purchases, better and more expensive products.

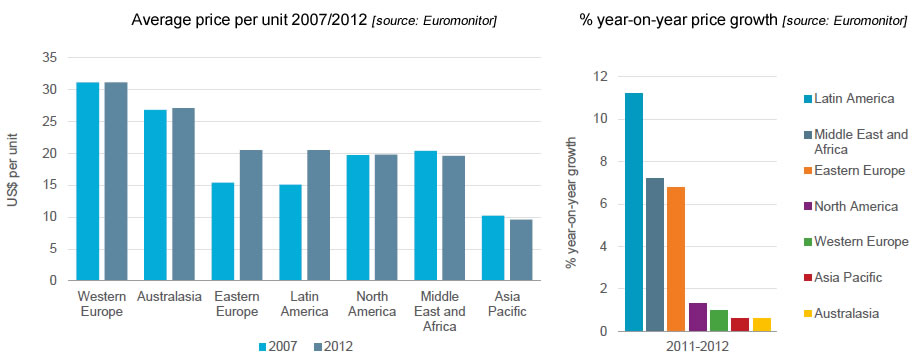

The highest average price per unit on the clothing market is in Western Europe, while the lowest in Asia Pacific. In the region of Western Europe, however, prices are relatively constant, due to unfavorable economic conditions in recent years and the development of competition, which results in greater discounts and promotions. The largest price increases in 2007-2012 were recorded in Latin America; similar growth was recorded in Eastern Europe – most likely due to the increase in demand and the relative enrichment of the society. Wool prices declined in 2012 from their highest level in the previous year, easing the pressure from producers to break even. In the same period, an increase in labor and production costs was also recorded, which outweighed the decreasing prices of materials, which resulted in the fact that in all regions in 2011-2012, a smaller or greater increase in prices for clothing industry products was recorded.

Other trends in the global clothing market are as follows:

- Online sales are gaining in importance and growing at the fastest pace. In the years 2007-2012, the highest increase in sales in this channel was recorded. M-commerce (trading via mobile devices) and s-commerce (trading supported by social media and friends’ advice) are becoming more and more popular in the clothing industry.

- As a result of increasing online sales, clothing industry specialists are investing more and more in store design to improve the perception of their stores, as it turns out that it is an increasingly important factor in choosing where to buy clothing products.

- Despite the slowdown in the Chinese apparel market, Pacific Asia remains the largest regional apparel market.

- The importance of Western Europe in the global clothing market will decrease in the coming years due to the ever stronger position of Asia Pacific. It is predicted that this region will account for 70% of overall sales growth in 2012-2017.

Apparel industry in Poland

The Polish clothing market is one of the most attractive and largest in Central and Eastern Europe. The latest estimates of its value indicate that it is worth approx. PLN 23.6 billion, and its value has been systematically growing in recent years, even despite the economic slowdown in Europe and the resulting greater propensity to save.

The economic problems we dealt with in 2009 had a negative impact on the growth dynamics. However, contrary to previous expectations, consumption did not stop completely, which is confirmed by the results of the study conducted for the purposes of the PMR report entitled “Retail trade in clothing and footwear in Poland 2010. Market analysis and development forecasts for 2010–2012”. According to the declarations of representatives of clothing and footwear chains, almost half of them recorded an increase in sales in 2010, and revenues by another 40%. remained unchanged. In addition, the hypermarket channel and internet sales recorded an increase in sales. Individual clothing stores were the segment that contributed to the greatest slowdown in the growth dynamics. In 2012, PMR estimated the growth of the clothing and footwear market by 2.5%. to PLN 27.7 billion in 2012, and in 2013 it forecasts a further growth of 3.6%. to the level of PLN 28.7 billion.

In 2011, there was an increase in cotton prices, as well as an increase in the VAT rate. The more expensive products did not reduce the demand, but it directed Poles’ attention to cheaper brands and increased the use of promotions and sales. The falling purchasing power of consumers, caused, inter alia, by Due to a very slow wage growth, distributors may in the future encounter problems with selling goods outside the periods of sales (in many cases, the phenomenon of maintaining a permanent state of promotion for products is noticeable).

There is also a growing interest in buying clothes in online stores, which prompts clothing companies to launch such distribution channels. Trade via the Internet is gaining more and more supporters in our country, where 63 %. citizens have access to the web. About 66% of them use the services of online stores, while in developed countries this indicator is approx. 90%, which proves the great potential of Poland as an insatiable market. Currently, the share of the online clothing distribution channel is slightly below 4%, but it is characterized by high dynamics (according to specialists, it will exceed the ceiling of 5% in 2016). Nevertheless, some items of clothing, especially those that require precise matching, such as pants or suits, are still rarely purchased electronically. A similar trend is characteristic for more expensive clothes, e.g. winter jackets. However, it is popular to buy shoes that have been tried on in a regular store.

Nevertheless, the most common places to buy are retail chains, where you can find clothes for all occasions in good quality and at affordable prices. New brands entering the market lower their prices in order to gain the largest possible share in the market. Poles do not show strong attachment to a specific brand, therefore such a strategy may be successful. On average, they spend around PLN 600 a year on clothes.

In 2011, the first decrease in the number of chain clothing stores, especially less known brands, was recorded, but the largest companies on the market were also closing their least profitable shops. On the other hand, a dynamic development was recorded in the discount store segment, the number of which increased by 20%, while the decreases in numbers at a similar level were recorded by stores with youth clothing and elegant men’s clothing. Still many Poles (approx. 1/5) prefer to buy clothes at the bazaar, although this tendency is slowly but steadily changing.

Research on consumer behavior shows that Poles are less and less interested in fashion and when choosing clothes, they are more guided by the functionality of the purchase – they prefer clothes that look good regardless of the season or current trends in the industry. In times of crisis, they often choose clothes from well-known brands that they associate with a favorable quality / price ratio, as evidenced by the positive opinions of the largest companies regarding the situation on the market.

The clothing market is very fragmented – the eight largest brands account for approx. 1/3 of sales. The rest goes to smaller companies and unbranded products. Among all clothes purchased in Poland, 59% is women’s clothing. The highest sales dynamics in this category is demonstrated by cheap denim pants, which were sold by 7.8% in 2011. more than a year earlier. In the case of men’s clothes, shirts are the leader in this statistics – 3.7%.

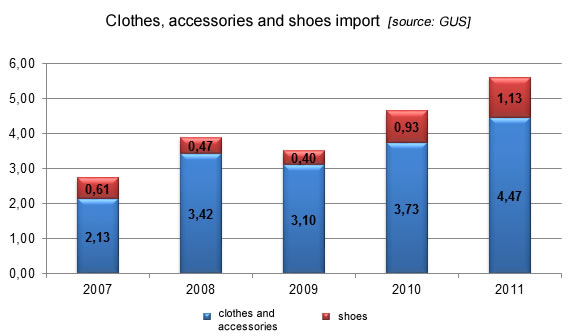

Articles from abroad play a significant role in the clothing sector in Poland. Since 2009, our country has had a negative trade balance in the category of clothes and clothing accessories.

A slight decline in the value of imported goods can be observed at the height of the crisis in 2009, but the situation improved in the following years. The annual growth rate of the value of imported products is noteworthy – in 2011 it amounted to 19.8%. for clothing and accessories, and 22.3%. in the case of shoes. The biggest jump was recorded in 2010 in the import of footwear, where it increased by as much as 131.4%. compared to the previous year. In 2011, imports amounted to USD 5.6 billion. More than 40% of the share went to goods manufactured in China, including for well-known Western European brands.