FMCG INDUSTRY

Our company will provide you with:

- defining a group of producers that meet your requirements,,

- selection of the best producers,

- organization of meetings with potential suppliers,

- translator and guide service,

- reservation of air and rail tickets,

- accommodate you in hotels,

- car rental.

Below we present our sample analyzes related to the FMCG industry. They concern the market situation in the world and in Poland. We also encourage you to familiarize yourself with the offer tailored specifically to customers from the FMCG industry.

World FMCG industry

After the crisis in 2008, the main trends in the global market for fast moving consumer goods (FMCG) can be identified:

- Emerging markets such as China, Brazil and India have been less hit by the crisis and tend to recover faster. This is mainly due to the much larger number of super- and hypermarkets that favor the development of the FMCG market in these countries.

- A common practice in the years after the financial crisis was selling at lower prices (trade down trend) and returning consumers to cheaper, less known products. Currently, there is a tendency to return to more prestigious brands.

- The change in demographic trends significantly affects many FMCG sectors. Lower birth rates and an aging population have a significant impact on consumption patterns, spending on health and hygiene products.

- The products from the FMCG industry, which recorded the largest increases in sales after the crisis (the so-called winners of the financial crisis), include mainly: headache and obesity medications, contraceptive products, ready-to-drink coffee and tea, cigars and food for children. These products can be described as not susceptible to the effects of the financial crisis.

- The FMCG industry products that recorded the largest drops in sales after the crisis (the so-called losers of the financial crisis) are primarily: wine, carbon-rich products, cleaning and polishing preparations, coffee, alcohol, toilet hygiene products and well-known cosmetics.

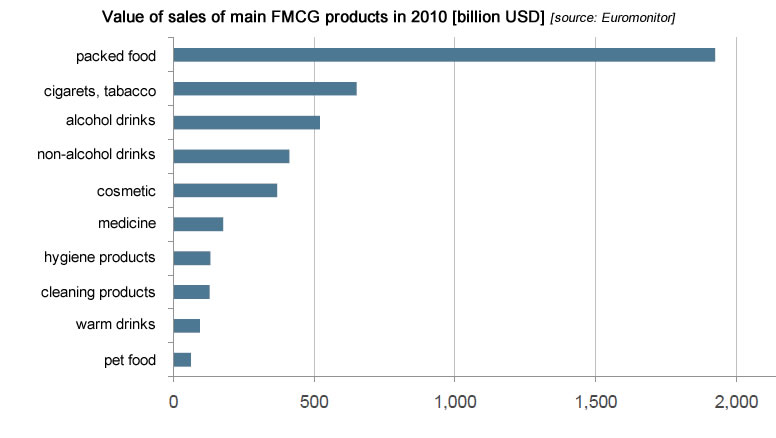

The main FMCG products include the so-called packaged products. They include, for example: food for children, pasta, bars, sweets and sauces, pastes, oils or frozen products. The next positions are taken by cigarettes and alcohol with a total annual sales value of around 1,200 billion dollars. The last places among the significant FMCG products are taken by hot drinks and food for animals.

FMCG industry in Poland

The FMCG (fast-moving consumer goods) industry covers a very wide range of fast moving consumer goods. They include, among others food products, including those intended for animals, cigarettes, beer, cosmetics, cleaning and personal care products, household chemicals, or small household items. For example, we will present an analysis of one of the most dynamically developing FMCG industries in Poland – the confectionery industry.

Over the past few years, production in the confectionery industry has been growing, depending on the product category, at a rate of several to several dozen % per year.

It seems that this segment of the food market is quite resistant to cyclical fluctuations in the economic situation – for example, despite the noticeable slowdown in 2008-2010, the production of the confectionery industry increased. The market has very good development prospects – currently the average consumption of sweets in Poland is several times lower than the consumption recorded on Western European markets.

When it comes to chocolate consumption, we are far behind Western European countries – in Poland, the average annual consumption per capita oscillates around 1.5 kg of chocolate, while in Germany or Belgium it is 10 kg.

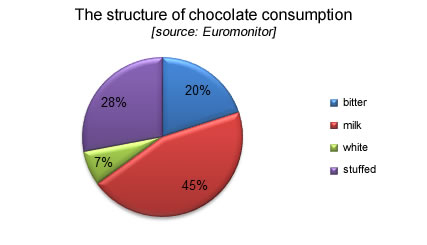

Traditionally, Poles like milk chocolate the most (45% share in the category sales), followed by filled chocolates (28%). Only 7 % of sales are generated by white chocolate. The only category whose consumption increased over the years 2007-2012 is dark chocolate (2007 – share in sales at the level of 18%. 2012 – 20%). The increase in dark chocolate sales comes at the expense of filled chocolates. The consumption of the remaining types of chocolate has not fluctuated over the past six years.

In the coming years, the confectionery market is expected to increase sales, both in terms of quantity and value. The increase in value will be caused, among others, by further increases in the prices of raw materials used in the production of sweets.

A special category of recipients of dessert sauces from the HoReCa industry are points selling ice cream. Ice cream is one of the fastest growing categories on the food market, in 2012 ice cream sales reached the level of PLN 1.3 billion.

It is estimated that the following market trends will affect the development of the confectionery market (including indirectly the development of the confectionery additives market):

- Further expansion of the so-called convenience products (ready-made). The change in lifestyle and its faster pace encourage you to buy products, although partially processed, that can be easily prepared at home. Producers who can save the customer’s time will win on the market.

- Increasingly common fashion for healthy eating and Health & Wellness products – a growing segment of consumers who care about their shape and healthy eating. With the growing awareness of consumers, producers of sweets will be forced to look for ways to ensure that products that are considered unhealthy and fattening, have a beneficial effect on our health, contain less sugar, do not contain hydrogenated vegetable oils, preservatives, artificial fillers, etc. Therefore, it is estimated that in the coming years, the popularity of, among others, dark chocolate products, which are a classic example of a healthy product due to the content of polyphenols, magnesium and other valuable ingredients.